A mix of provide chain chaos, greater prices and issues about working circumstances is forcing some western vogue manufacturers to rethink their decades-old dependence on factories in China.

Dieter Holzer, the previous chief govt and a board member of Marc O’Polo, mentioned the Swedish-German vogue model began to swap some suppliers within the nation in favour of factories in Turkey and Portugal in 2021.

The choice was meant to “steadiness and take out threat out of your provide chain and make it extra sustainable”, he mentioned. “I believe many corporations throughout the business are reviewing their publicity [to China].”

The shift away from mass textile manufacturing within the nation, albeit nonetheless in its early phases, marks the reversal of years of outsourcing to a area that has come to dominate the textile supply chain.

Huge names resembling Mango and Dr Martens have just lately minimize or signalled their intention to shift manufacturing out of China or south-east Asia.

“The large message is lowering reliance on China,” Dr Martens’ chief govt Kenny Wilson mentioned in November. “You don’t need your entire eggs in a single basket.”

The bootmaker has moved 55 per cent of its whole manufacturing in a foreign country since he took over in 2018. Simply 12 per cent of its manufacturing for the 2022 autumn/winter assortment was manufactured in China in contrast with 27 per cent in 2020 and it estimated it will drop to five per cent this 12 months.

“We’re being deafened by the sound of garments producers [moving] away from Asia,” mentioned Rosey Hurst, director of moral enterprise consultancy Impactt.

The relocation was additionally being pushed by stricter legal guidelines being launched within the US and Europe towards labour abuses, she added, following the alleged use of compelled labour within the cotton-rich territory of Xinjiang in China.

Mango’s chief govt Toni Ruiz mentioned in December he was contemplating shopping for much less from China “however we’ll be very alert to how issues evolve”.

“What we’re taking a look at is the extent to which all this world sourcing, developed over a few years, would possibly grow to be extra native,” he mentioned.

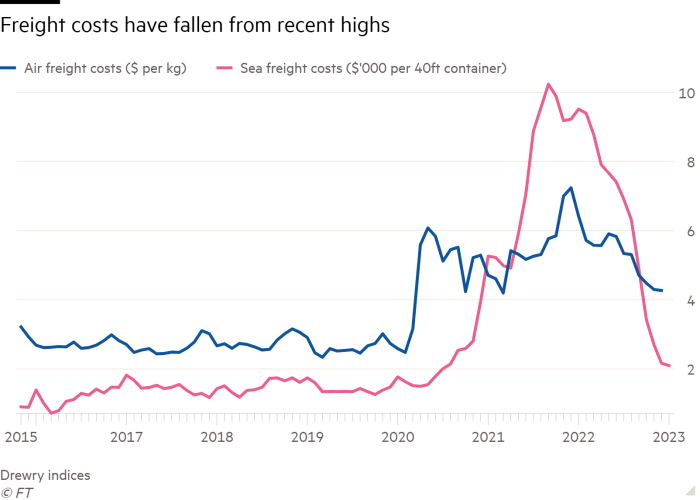

The shift was accelerated by continued provide chain disruption for the reason that onset of the Covid-19 pandemic, which led to a bounce in freight prices, in addition to important shipping delays as manufacturing unit staff at manufacturing hubs throughout Asia fell ailing or have been compelled to isolate.

One business guide mentioned that one retail consumer’s ski put on, from a earlier season, arrived in the summertime of 2022.

“For a lot of, gone are the times of producing solely in China and delivery in all places,” mentioned Todd Simms, vice-president at provide chain intelligence platform FourKites.

“Disruptions have elevated prices to ship completed items, making it simpler to justify operations in new international locations in alternate for extra resilience,” he added.

The monetary incentives to stay within the area are diminishing as wages go up after years of low-cost labour — a serious draw for a lot of family names to outsource manufacturing to far-flung locations.

In response to statistics from China’s Nationwide Bureau of Statistics, the typical manufacturing unit wage doubled between 2013 and 2021, from Rmb46,000 ($6,689) per 12 months to Rmb92,000.

Jose Calamonte, chief govt of on-line vogue retailer Asos, instructed buyers on the firm’s full-year outcomes presentation final 12 months that merchandise manufactured in China weren’t as aggressive as they appeared relative to Europe, as soon as delivery and transport prices have been taken under consideration.

“We attempt to consider the ultimate [profit] margin as soon as we’ve made the ultimate sale,” he mentioned.

European clothes retailers’ efforts to chop supply instances, as vogue developments and shopper wants change rapidly, is another excuse behind their determination to go for suppliers nearer to residence.

“We’ve been taking management of our manufacturing,” mentioned a spokesman for a British luxurious model, including that the business has been consolidating in Europe for years now. “This has been a pattern for causes to do with velocity and effectivity.”

Plans to shift manufacturing away from Asian garment hubs, nevertheless, are usually not that superior owing to their complexity. Nations resembling China and Vietnam signify the lion’s share of textile exports, in accordance with 2020 information from CEPII.

For instance, greater than half of suppliers to Inditex, the world’s largest vogue retailer, have been primarily based in Asia in 2021, solely a marginal discount on 2018.

Turkey has been positioning itself as a winner from western manufacturers shifting their manufacturing, not least as a result of it’s a part of the EU customs union, permitting frictionless commerce between member states.

“It’s a fashionable vacation spot and already utilized by the likes of Hugo Boss, Adidas, Nike, Zara,” mentioned Simon Geale, govt vice-president of procurement at provide chain consultancy Proxima.

An more and more vital consideration for retailers is traceability within the provide chain after years of extensively reported labour abuses.

“[Because of US laws against cotton from Xinjiang], manufacturers need to have a lot better traceability, ” mentioned Impactt’s Hurst.

“Then we’ve got obtained European legal guidelines [on forced labour] arising. It’s placing strain on the business to get a grip,” she mentioned.

However she warned: “There isn’t sufficient cash in [international supply chains] to run issues the best way they need to be finished. [Given the current economic crisis], that’s solely going to worsen.”

Maximilian Albrecht, an analyst at AlixPartners, mentioned that many quick vogue labels have been additionally abandoning China with a purpose to differentiate themselves from Shein, the quickly rising Chinese language quick vogue large.

“European manufacturers can’t match Shein on their prices of manufacturing, their community of manufacturing, their relationships,” Albrecht mentioned.

“I believe you’ll see some manufacturers say ‘properly, we are able to’t match that so we’ll transfer to Europe’. You’ll be able to nonetheless promote the story that they’ve greater high quality merchandise. Whether or not that’s really true is one other factor.”